Planning for retirement is essential for long-term financial security, and two of the most powerful tools available to many Americans are the 401(k) and Individual Retirement Account (IRA). Understanding how to effectively use these accounts can help you maximize your retirement savings and enjoy a comfortable future.

What Are 401(k) and IRA Accounts?

401(k): A workplace-sponsored retirement savings plan that allows employees to contribute a portion of their paycheck before taxes are taken out. Many employers offer matching contributions, which is essentially free money for your retirement.

IRA (Individual Retirement Account): A personal retirement account that individuals can open independently of their employer. IRAs come in two main types: Traditional (tax-deferred) and Roth (post-tax contributions with tax-free withdrawals in retirement).

How to Maximize Your Retirement Savings Using These Accounts

1. Contribute Enough to Get the Full Employer Match (401(k))

If your employer offers a matching contribution, contribute at least enough to get the full match. For example, if your employer matches 50% of your contributions up to 6% of your salary, aim to contribute 6%. This match boosts your savings immediately without extra effort.

2. Understand Contribution Limits

In 2025, the contribution limits are:

401(k): $23,000 per year (with a $7,500 catch-up contribution if you’re 50 or older)

IRA: $7,000 per year (with a $1,000 catch-up contribution if you’re 50 or older)

Maximizing contributions within these limits accelerates growth through compound interest.

3. Choose the Right IRA for Your Situation

Traditional IRA: Contributions may be tax-deductible, reducing your taxable income today. Taxes are paid when you withdraw in retirement.

Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free. Ideal if you expect to be in a higher tax bracket later.

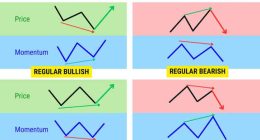

4. Diversify Your Investments

Both 401(k)s and IRAs allow you to choose how to invest your funds. A diversified mix of stocks, bonds, and other assets can reduce risk and improve returns over time. Consider low-cost index funds or target-date funds designed to adjust risk as you age.

5. Automate Contributions

Set up automatic payroll deductions or monthly transfers to your IRA to make saving consistent and effortless. Automation helps you avoid the temptation to skip contributions.