Navigating the various types of finance jobs involves understanding the different roles, responsibilities, skills required, and career paths available in the finance industry. Here’s a guide to help you navigate the diverse landscape of finance jobs:

Understand Different Finance Specializations:

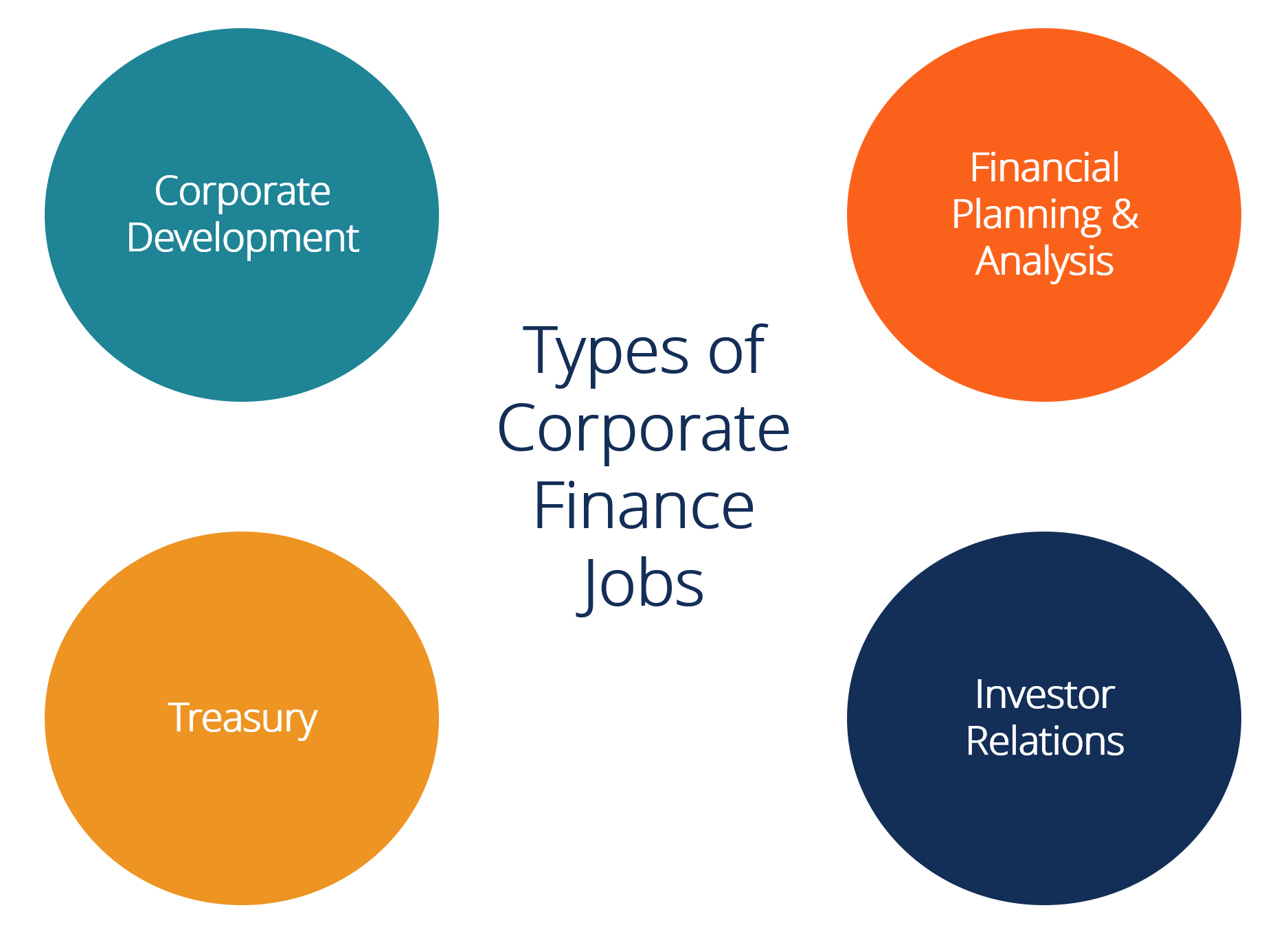

Familiarize yourself with different areas of finance, including investment banking, corporate finance, financial analysis, risk management, asset management, financial planning, and accounting. Each specialization has its own focus, functions, and career opportunities.

Assess Your Interests and Skills:

Reflect on your interests, strengths, skills, and career aspirations to determine which finance specialization aligns best with your goals. Consider your academic background, professional experience, personality traits, and areas of expertise when exploring finance job opportunities.

Research Finance Career Paths:

Research various finance career paths to understand the roles, responsibilities, qualifications, and career progression opportunities available in each specialization. Explore job descriptions, industry trends, salary ranges, and job market demand to inform your decision-making process.

Gain Relevant Education and Training:

Pursue a relevant degree, certification, or professional qualification that aligns with your chosen finance specialization. Obtain specialized knowledge, technical skills, and credentials required for entry-level and advanced finance roles. Consider pursuing certifications such as Chartered Financial Analyst (CFA), Certified Public Accountant (CPA), or Financial Risk Manager (FRM) to enhance your credentials and marketability.

Gain Practical Experience:

Seek internships, co-op programs, part-time jobs, or volunteer opportunities to gain hands-on experience and exposure to different finance roles. Apply theoretical knowledge to real-world situations, build your resume, and develop valuable skills, contacts, and industry insights.

Network Within the Finance Industry:

Build relationships with professionals, alumni, mentors, and industry contacts in the finance industry. Attend networking events, industry conferences, career fairs, and informational interviews to expand your network, learn about job opportunities, and gain advice from experienced professionals.

Explore Entry-Level Finance Roles:

Consider entry-level finance roles such as financial analyst, junior accountant, investment banking analyst, or financial planner to gain foundational experience and build a strong foundation in finance. Be open to starting in a generalist role and gradually specializing in a specific area of finance over time.

Develop Transferable Skills:

Develop transferable skills such as analytical thinking, problem-solving, communication, teamwork, attention to detail, and adaptability that are valued across different finance roles. Cultivate a strong work ethic, professionalism, and a commitment to continuous learning and development to excel in your finance career.

Pursue Career Advancement Opportunities:

Seek opportunities for career advancement, growth, and development within your chosen finance specialization. Set career goals, pursue additional education or certifications, take on challenging assignments, and seek mentorship and guidance from senior professionals to advance your career in finance.

Stay Informed and Adapt:

Stay updated on industry trends, market developments, regulatory changes, and emerging technologies impacting the finance industry. Adapt to evolving job market demands, changing business environments, and career opportunities in the dynamic finance landscape.

By following these tips and taking a proactive approach to navigating the various types of finance jobs, you can identify career paths that align with your interests, skills, and aspirations and pursue opportunities for success and advancement in the finance industry.