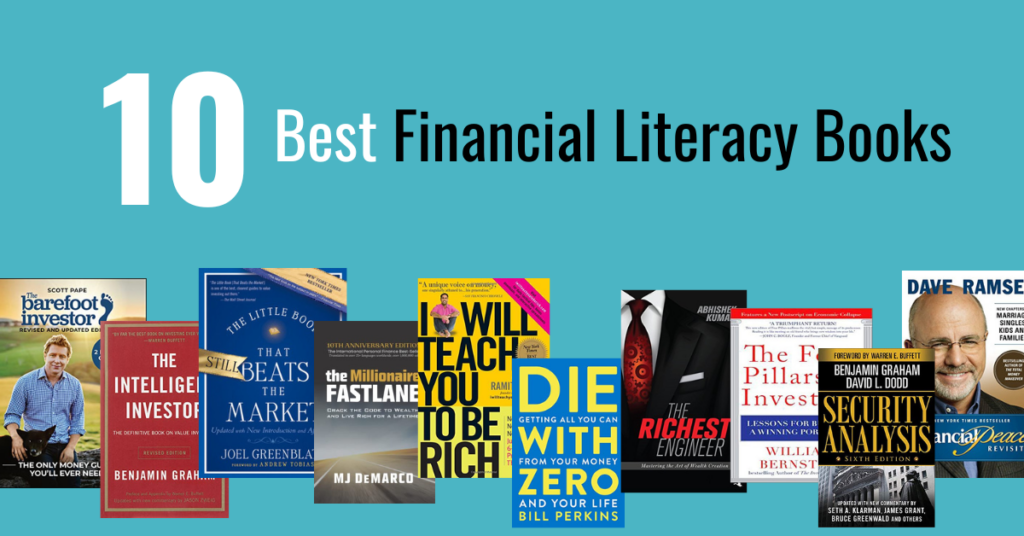

Sure! Here are ten finance books that cover various aspects of personal finance and investment, suitable for individuals looking to improve their financial literacy:

“The Total Money Makeover” by Dave Ramsey:

This book offers practical advice on getting out of debt, building an emergency fund, and creating a solid financial plan for the future.

“Rich Dad Poor Dad” by Robert T. Kiyosaki:

In this book, Kiyosaki shares insights from his childhood and contrasts the financial philosophies of his “rich dad” and “poor dad,” offering valuable lessons on building wealth and achieving financial independence.

“The Intelligent Investor” by Benjamin Graham:

Considered a classic in value investing, this book provides timeless principles and strategies for successful investing in the stock market.

“I Will Teach You to Be Rich” by Ramit Sethi:

Sethi offers a six-week personal finance program focused on automating finances, optimizing spending, and investing for the future, with a practical and no-nonsense approach.

“Your Money or Your Life” by Vicki Robin and Joe Dominguez:

This book challenges conventional notions of money and happiness, guiding readers to achieve financial independence and align their spending with their values.

“The Little Book of Common Sense Investing” by John C. Bogle:

Bogle, the founder of Vanguard Group, advocates for a low-cost, passive investing approach through index funds, offering insights into building wealth over the long term.

“Money: Master the Game” by Tony Robbins:

Robbins interviews top financial experts and shares their insights on mastering money, investing, and achieving financial freedom.

“The Richest Man in Babylon” by George S. Clason:

Set in ancient Babylon, this book offers timeless financial lessons through parables and stories, emphasizing the importance of saving, investing, and wealth-building habits.

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko:

Based on extensive research, this book explores the habits and characteristics of America’s wealthy individuals, dispelling common myths about wealth and offering practical advice for building wealth.

“Broke Millennial: Stop Scraping By and Get Your Financial Life Together” by Erin Lowry:

Geared towards millennials, this book covers a wide range of personal finance topics, including budgeting, saving, investing, and navigating financial challenges unique to young adults.

These finance books offer valuable insights, practical advice, and actionable strategies to help readers improve their financial literacy, make informed financial decisions, and achieve their financial goals.