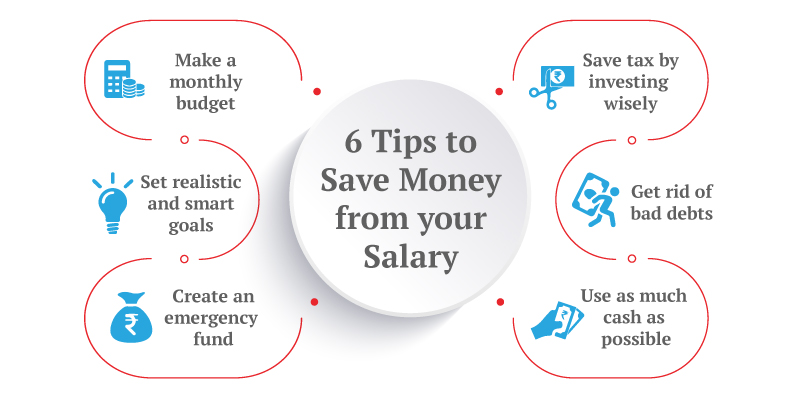

Saving money effectively is crucial for achieving financial stability and reaching your long-term goals. Here are six finance tips to help you save money more effectively:

Set Clear Savings Goals:

Define specific and achievable savings goals, whether it’s building an emergency fund, saving for a down payment on a house, or planning for retirement.

Break down your goals into smaller, manageable milestones with deadlines to help you stay motivated and track your progress.

Create a Budget and Track Your Expenses:

Develop a monthly budget that outlines your income, fixed expenses (e.g., rent, utilities), variable expenses (e.g., groceries, entertainment), and savings goals.

Track your spending regularly to identify areas where you can cut back and allocate more money towards savings.

Automate Your Savings:

Set up automatic transfers from your checking account to your savings account or investment accounts each month.

Treat your savings contributions like any other recurring bill, ensuring that you prioritize saving money before spending on discretionary expenses.

Reduce Unnecessary Expenses:

Review your monthly expenses and identify non-essential items or services that you can cut back on or eliminate altogether.

Look for opportunities to save money on recurring expenses, such as renegotiating utility bills, canceling unused subscriptions, or switching to cheaper alternatives.

Take Advantage of Employer Benefits:

If your employer offers retirement savings plans like a 401(k) or a Health Savings Account (HSA), take full advantage of these benefits.

Contribute enough to your employer-sponsored retirement plan to maximize any matching contributions, as this is essentially free money that can accelerate your savings growth.

Build an Emergency Fund:

Prioritize building an emergency fund to cover unexpected expenses or financial emergencies, such as medical bills, car repairs, or job loss.

Aim to save at least three to six months’ worth of living expenses in a liquid, easily accessible account, such as a high-yield savings account or a money market fund.

By implementing these finance tips, you can develop healthy saving habits, build your savings steadily over time, and achieve greater financial security and peace of mind. Remember that saving money is a gradual process that requires discipline and commitment, but the rewards of financial stability and freedom are well worth the effort.